electric car company incentive

Federal and State Electric Car Tax Credits Incentives Rebates. Electric car company incentive Friday April 8 2022 Edit.

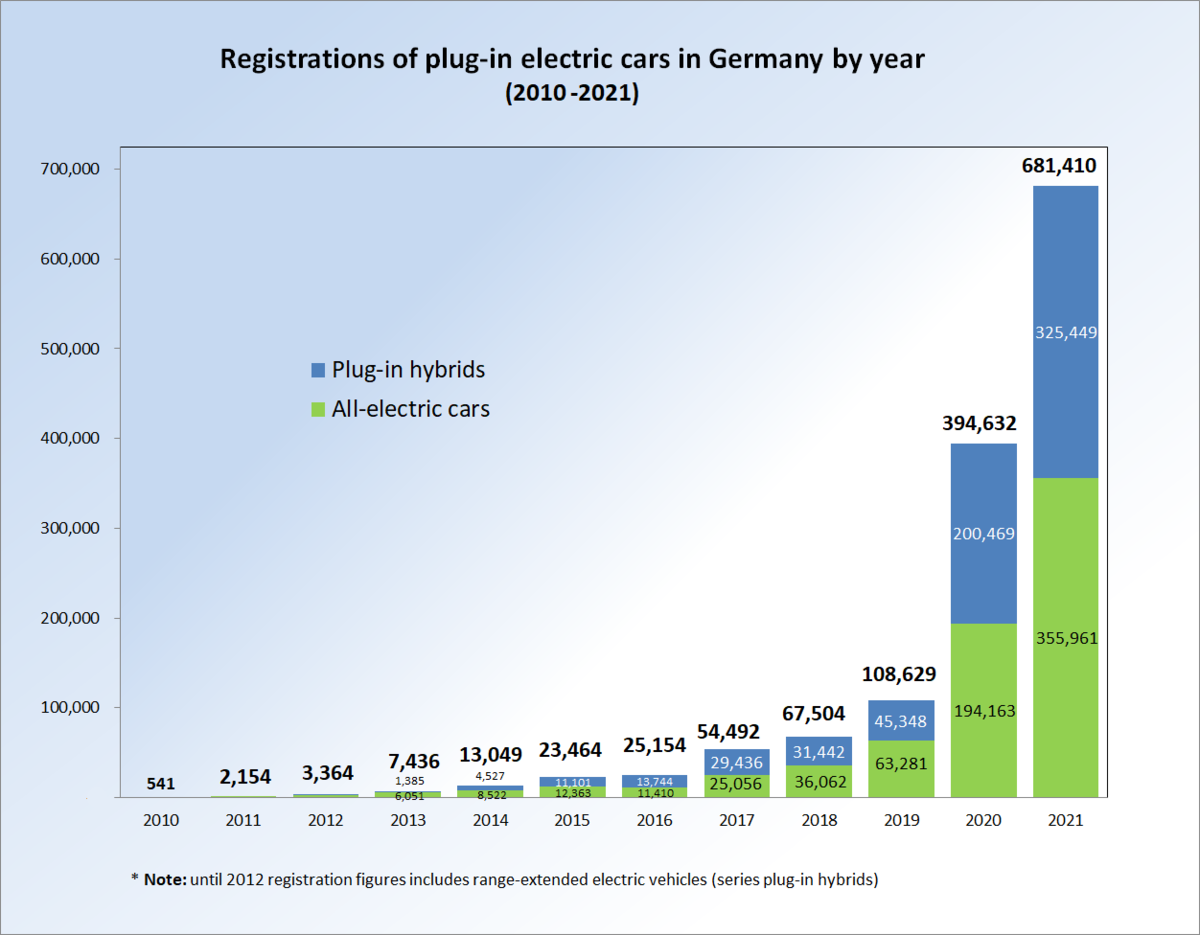

Plug In Electric Vehicles In Germany Wikipedia

We will install more than 200 plug-in electric vehicle EV chargers at qualifying business customer locations and contribute up to 5000 toward equipment and installation.

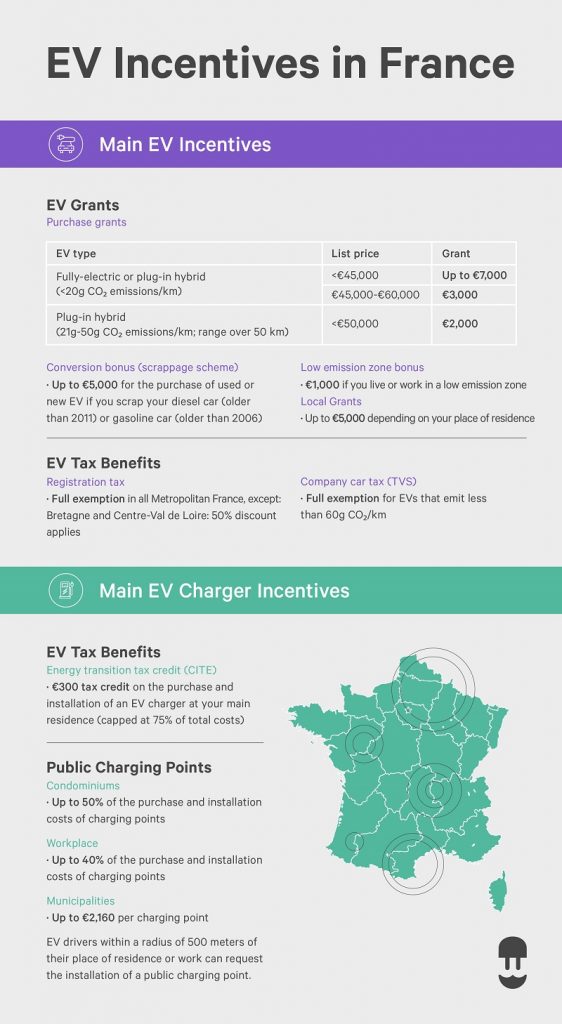

. Offer helpful instructions and related details about Florida Electric Car Incentive - make it easier for users to find business information than ever. Electric company car tax. France offers a generous eco bonus of up to 6000 to buyers of electric vehicles.

Through the Electric Vehicle Supply Equipment EVSE Incentive Austin Energy customers may be eligible to receive a 50 rebate for purchasing and installing a qualified Level 2 charger. 100 First Year Allowance FYA First Year Allowance is claimable for up to 100 of the cost of qualifying low emission and electric cars. This can be boosted by a scrappage bonus of up to 5000 for older diesel and petrol vehicles which amounts to a total bonus of 11000.

Back then it was worth up to 35 of the cost of a new vehicle with a 5000 cap. Here are the currently available eligible vehicles. Uk Electric Vehicle Motor Market Size Share Forecast To 2025 Electric Cars Commercial Vehicle Electricity.

Although youre technically able to charge your car using a regular 110 volt outlet its much quicker to use a Level 2 charger 240V. By choosing a Tesla car your business can claim a 100 year one deduction for the cost of the vehicle. This means that provided the business makes sufficient profits the purchase cost can be written off immediately in year one.

January 13 2022 - To get the federal EV tax credit you have to buy a new and eligible electric car. The 100 ECAs allowance provided for new electric cars is not available however capital allowances can be claimed on an annual basis at 18. However this is rising to 1 from 6 March 2021 and again to 2 from 6 March 2022.

Company car tax is closer aligned to a cars tailpipe emissions than VED and rates are calculated dependingon which CO2 band the car sits in. 7350 for gross price of up to 32000 1500 if price. This means with electric cars you can deduct the full cost from your pre-tax profits.

Company Car Tax Incentives to Go Electric. The UK government offers a financial incentive for those wishing to drive electric administered by the Office of Zero Emission Vehicles OZEV. Benefit in Kind Company Car Tax Rules Review of WLTP and Vehicle Taxes Budget 2020.

Tend to be cheaper than comparable electric vehicle models. The Plug-In Car Grant. Currently 2500 only cars that have CO2 emissions of less than 50gkm and can travel at least 70 miles with zero emissions are eligible.

What is a company car how do they work. From 6 March 2020 the benefit in kind has been 0. The valuation of the benefit in kind depends on the list price of the car and its CO2 emissions.

Ola Electric is a company that leases electric cars. One way is through Tampa Electrics new Drive Smart program. The program aims to cut net emissions to zero by 2050 and for.

With all BEV drivers paying just 2 in 2022-23 and the tax rate frozen until at least 2025 a further increased uptake of fully electric company cars is to be expected. Where the Company purchases the electric vehicle as a company car there is also a corporation tax saving to be made. A company car is one owned by a business and provided to an employee for their use.

There are many incentives for buying an electric car in the UK including plug-in grants for low emission vehicles zero or reduced road tax bills and accessible on-the-go electric charge points across UK road networks. But thats all about to change that is if youre happy to get an electric car. A Guide To Electric Car Grants And Incentives Rac Drive.

Electric car company incentive Saturday February 26 2022 Edit. Its like the cycle to work scheme for electric cars. The amount of company car tax payable depends on the official value of the car called the P11D the Benefit-in-Kind BIK rate and the recipients tax code.

These vehicles must have been approved. Other incentives offered by the French government include exemption from registration and road tax as well as a reduced company car tax of just 20 per. The Electric Car Scheme.

Cars with CO2 emissions of less than 50gkm are also eligible for 100 first year capital allowances. The Canadian federal governments EV incentives program offers up to 5000 for the first registered owner of a battery-electric hydrogen fuel cell and longer range plug-in hybrid vehicles. As electric vehicles become more popular how can your business serve their drivers and capture that forward-thinking market segment.

The Electric Car Scheme sets up and manages the salary sacrifice scheme for your company at no cost. This is a particularly attractive incentive for owner-managed companies especially where the company director might be looking for a new electric car for themselves. The EV grant limit is now capped at 1500 and its only available on cars costing less than 32000.

Along with station management and incentive funding services. The HM Treasury is strongly incentivising full battery electric vehicles BEVs using these tax rates and offers a more modest incentive on plug-in hybrid electric vehicles PHEV. Company cars used to be a common method of doing that but over recent years the tax charged has made them unattractive.

Salary sacrifice lets you pay from your salary before tax. The amount of the electric car grant - often referred to as the Plug-in Car Grant PICG - has fallen steadily since its introduction in 2011. For example a fully electric car that cost 50000 would give rise to a benefit in kind of 0 in.

SAVE 30-60 ON ANY ELECTRIC CAR. Startups developing electric cars their components like batteries and ecosystem. In addition to broad-scale electric vehicle incentives states and utilities provide incentive programs rebates and tax credits specifically for purchasing and installing EV charging equipment across the country.

Shorter range plug-in hybrid electric vehicles are eligible for an incentive of 2500. Leasing a car through the company could be done through a tax efficient salary sacrifice arrangement if ownership is corporate. Short range electric vehicles.

Federal and State Electric Car Tax Credits Incentives Rebates.

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

Everything You Need To Know About Ev Incentives In The Netherlands Evolve

Electric Vehicles Tax Benefits And Purchase Incentives In The Eu By Country Acea European Automobile Manufacturers Association

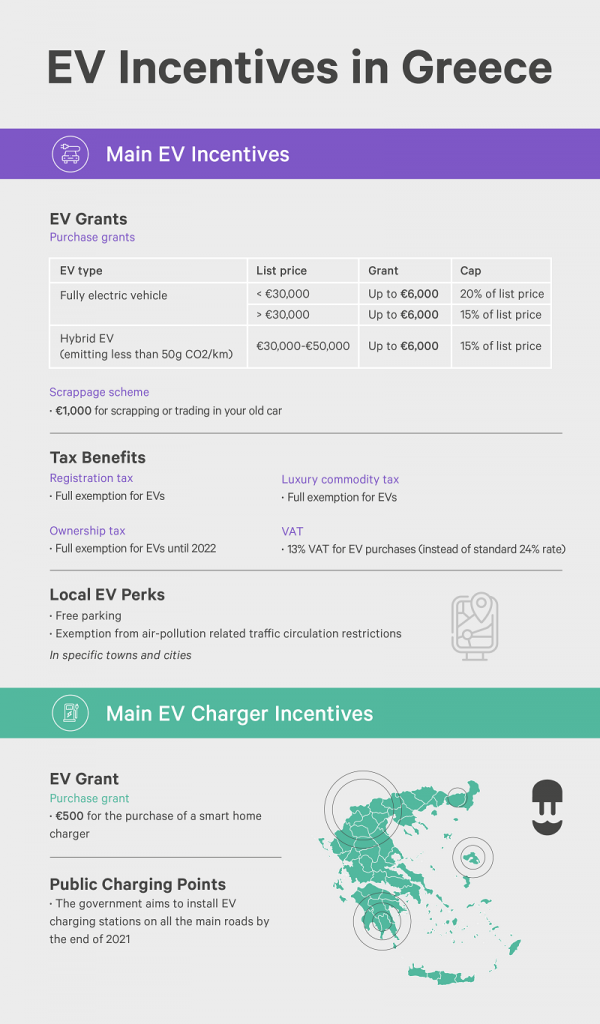

Ev Ev Charging Incentives In Greece A Complete Guide Wallbox

Ev Incentives In France Complete Guide Wallbox

A Complete Guide To Ev Ev Charging Incentives In The Uk

The Uptake Of Plug In Hybrid Electric Vehicles In Europe S Company Car Fleets Trends And Policies International Council On Clean Transportation

The Uptake Of Plug In Hybrid Electric Vehicles In Europe S Company Car Fleets Trends And Policies International Council On Clean Transportation

Ev Incentives Ev Savings Calculator Pg E

Small But Mighty The Netherlands Leading Role In Electric Vehicle Adoption International Council On Clean Transportation

Small But Mighty The Netherlands Leading Role In Electric Vehicle Adoption International Council On Clean Transportation

Government Electric Car Grants Save On Your Ev Leasing Options

Which Governments Are Promoting Electric Vehicles The Most

Overview Electric Vehicles Tax Benefits Purchase Incentives In The European Union 2021 Acea European Automobile Manufacturers Association

Analysis And Testing Of Electric Car Incentive Scenarios In The Netherlands And Norway Sciencedirect

Economic Recovery Packages In Response To Covid 19 Another Push For Electric Vehicles In Europe International Council On Clean Transportation

Tesla Toyota And Honda Criticize 4 500 Tax Credit For Union Made Evs

Ev Ev Charger Incentives In Europe A Complete Guide For Businesses Individuals

Small But Mighty The Netherlands Leading Role In Electric Vehicle Adoption International Council On Clean Transportation